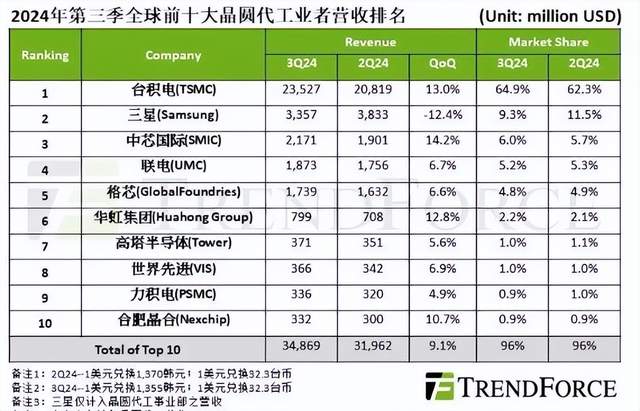

The replacement of domestic chips is accelerating, and TSMC's growth rate is also losing to Chinese chips, with Samsung suffering the most

According to the revenue data of the top ten chip foundry companies in the world released by market research institution TrendForce in the third quarter of this year, the data shows that the chip companies in Chinese Mainland have the fastest growth rate, even surpassing TSMC. This indicates that even though TSMC has the most advanced technology, it has also been affected to some extent by the promotion of domestic chip substitution in the Chinese Mainland market.

Data shows that among the top ten chip foundry companies, SMIC has the fastest growth rate, with a year-on-year increase of 14.2% in the third quarter, while TSMC's growth rate is 13.0%. Although SMIC mainly focuses on developing mature processes, due to its progress in 14nm and N+1 processes, as well as the support of Chinese Mainland chip design companies, its revenue growth rate still surpasses that of TSMC.

From the perspective of chip manufacturing technology, TSMC is now almost the only player in the market for 7nm and below processes. This is because its competitor Samsung cannot compete with TSMC in terms of transistor density, yield, and other aspects of processes below 7nm. Therefore, TSMC has gained the most customer support in advanced process technology.

Previously, Samsung had also received orders from Qualcomm, but the Snapdragon 8 Gen 1 processor produced by Samsung had heating issues. Eventually, Qualcomm handed over all orders for the Snapdragon 8 Gen 2 and beyond to TSMC. This led to a 12.4% decline in Samsung's chip foundry revenue in the third quarter, making it the only chip foundry among the top ten to experience a decline.

In the technology below 14 nanometers, besides TSMC and Samsung, another company is SMIC. Due to its more advanced technology compared to UMC and GlobalFoundries, SMIC has been ahead since last year.

In the technology of 14 nanometers and above, TSMC, Samsung, SMIC and other companies have launched fierce competition. In these processes, the competition is not only about technology, but also about customer preference and chip foundry cost. Several years ago, China decided on the strategy of prioritizing the development of mature process chips. Domestic breakthroughs have been made in storage, simulation, CMOS chips, etc. Considering the security of chip foundry, most of these domestic chips are handed over to local chip foundry enterprises such as SMIC, Shanghai Huahong, and Hefei Jinghe Integrated. Recently, relevant departments have strongly recommended that domestic chips should be adopted as much as possible, taking into account the requirements of information security and other aspects. This has further promoted the development of domestic chips. The revenue growth rate of the three major domestic chip foundry enterprises has exceeded 10%, proving that domestic chips have indeed achieved significant sales growth.

As China promotes the substitution of domestically produced chips, China, as the world's largest chip purchaser, is gradually reducing its chip purchases, leading to a decline in sales for many overseas chip companies. They have reduced orders for mature process chips from companies such as TSMC, Samsung, and UMC. In order to compete for limited orders, Samsung, UMC, and TSMC have had to significantly lower their prices by 10%, which in turn affects TSMC. After all, mature processes still account for about 40% of TSMC's revenue, resulting in TSMC's revenue growth rate being lower than that of SMIC.

Chinese chip will hand over the order to local chip companies such as SMIC International. Another consideration is the cost. The cost of Chinese chip OEM is lower. Some mature chips in the United States are also handed over to Chinese chip OEM. Recently, European Italian Semiconductor, which has chip manufacturers, also handed over the chips to chip companies in Chinese Mainland. This shows the cost advantage of Chinese chip manufacturing.

I'm afraid TSMC can't imagine that it has the most advanced technology, but because of the impact of cost and other factors, it has lagged behind the chip foundry enterprises in Chinese Mainland in terms of revenue growth. The fact shows that the Chinese market has a great impact on the global chip market, which is now beginning to affect TSMC. The Chinese market is a market that can't be ignored by any chip enterprise.

right 2023. Chinaic Technology Co. ,Ltd. All Rights Reserved 粵ICP備13001812號(hào)